Sogn Farm Project

Corn and squash fields mowed for the winter.

Last week a neighbor came by with a flail mower and chopped the remaining corn stalks and what remained of the squash plants. All that organic matter can now decompose over the winter and return to the soil. With that – and a few remaining minor chores – the 2021 Farm to Foodshelf season draws to a close. Thank you to all the donors who took us past our $6,000 goal, to all the volunteers who harvested, processed and delivered carrots, corn, beets and squash, and to the cooperating food shelves and institutions including The Food Group. Huge thanks to Dana Jokela of Sogn Valley Farm – this couldn’t happen without you. Even with the loss of 2/3 of our planned corn planting we still had an excellent season.

Now it’s time to look to the future – the future of this project and the future of our farm. How can the land we now steward best serve our communities? Over the coming months I hope to craft a longer range vision for our farm using what we’ve learned about this place over the last 10 years, and what we’ve learned about communities’ needs over the last couple of years. Comments, thoughts and ideas are welcome! Feel free to comment on this post, email me or get in touch some other way.

Once again, from the bottom of my heart, thank you.

Thank you to all who have contributed to the Farm to Foodshelf project! We’re so close . . . with two more days to go we only need $400 to reach our $6,000 goal to pay our partner farmer Dana Jokela for all his work, fuel, equipment and so on. Can you help? It’s tax-deductible on this GiveMN page. Thanks!

With a soundtrack from Smack and Lolo Young Walser, see yourself and your friends in this brief (just over 2 minutes) romp through the 2021 growing season on our farm!

It was a sunny Sunday for filling the truck one more time with winter squash and this morning I took the last of the harvest to People Serving People “the largest and most comprehensive emergency shelter for families experiencing homelessness in Minnesota and a dedicated leader in homelessness prevention’, Camden Promise at Gethsemane Lutheran Church in North Minneapolis and VEAP (Volunteers Enlisted to Assist People) which was suggested by Jerome Ryan. As ever, I was overwhelmed by the staggering need and grateful for the opportunity to lend a hand. I’ll follow this post with a season summary but, as ever, your tax-deductible financial support of this project via this GiveMN page will help pay our heroic cooperating farmer, Dana Jokela, for his time, expertise, use of equipment, fuel and more. Please help us finish the season with a solid check for Dana! Thank you.

L-R: Barb Rose, Cara Rodriguez, Johanna Gorman-Baer, Chuck Lentz, Julie Young, Jenny

A sunny Sunday morning in Sogn was perfect for this crew to gather another 1,382 pounds of squash, which was donated today (Tuesday Oct 12th) to Second Harvest Heartland (thanks, Heidi Coe). This brings our squash total to 12,743 pounds – over 6 tons! And there is still more in the field . . . Thank you Chuck, Barb, Cara, Julie, Joahnna (and Jenny, of course) and Rina, Hans, Cathy, Mark, Lisa, Sarah and Oswaldo who either arrived too late for squash (we filled those boxes in an hour and a half!) or had to leave before we started but still enjoyed a visit to the farm.

As long as we don’t have a hard frost, the squash remaining in the field can still be harvested. There is still about 50 -75 feet of the field that has barely been touched. This crop has been way beyond my wildest hopes. Thanks everyone!

Unloading our squash at Second Harvest Heartland

Our acorn and delicata squash in the Second Harvest warehouse

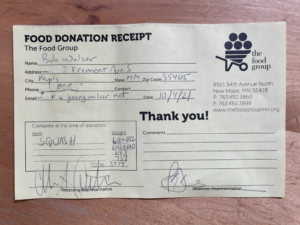

This morning I took the first six pallets from Saturday’s harvest up the The Food Group who will distribute the squash to Food Banks around the metro area. They weighed each pallet. Based on last year’s harvest I was guessing about 500 pounds a pallet or about 3,00o pounds total. The total: 3,979 – almost half a ton more than I expected! Thanks again to all who helped. You did more than you knew!

First 2021 Squash Delivery to The Food Group

2021 Squash Delivery Receipt from The Food Group

Squash Harvest Volunteers, 2021

This was one amazing year for squash. With the help of a huge volunteer crew we gathered north of 9,000 pounds of delicata, butternut and acorn squash. Over the next few days I’ll be bringing these to The Food Group (in New Hope) and Channel One (in Rochester) for distribution to food banks across the Twin Cities metro and Southern Minnesota. In addition to the work we also had a great potluck and music – it was a glorious day! Thank you to: Amy Shaw, Ann Farrell, Ari, Barb Pratt, Barb Rose, Benjamin Domask, Chris Bashor, Chuck Lentz, Dave Underhill, Deb Liang, Dug Nichols, Isaac, Joan Weber, Jon Freise, Kim Muehlbach, Matt Tillotson, Mike Muehlbach, Miriam Kowarski, Oswaldo, Pat O’Loughlin, Patti Nichols, Rachel FK, Sarah McCarthy, and Sarah Purdy. This harvest was much, much bigger than last year’s so it was a lot more work. Thank you, one and all! (Sorry not everyone is included in the group photo, people came and went during the day.)

Dana Jokela offloads the first pallet of winter squash

We couldn’t do all this without help from Dana Jokela at Sogn Valley Farm. Dana’s expertise, help and equipment have been essential to this project. As you anc imagine, tractors, planters, cultivators and fuel are expensive. Please help me raise funds to pay Dana for all of his contributions. You can make a tax-deductible donation on this GiveMN page.

Volunteers loading winter squash for food shelves.

Pat, Bob, Chris and Amy playing some tunes at the 2021 squash harvest

Chris, Bob, Amy and Pat play tunes during the 2021 squash harvest potluck

A perfect morning for harvesting and what a group of friends! Thanks to (L-R) Cara, Barb, Vi, Miles, Samson, Roger, Chuck, Barb, Eric, Robin, Dug and Daisy plus (not pictured) Jo, Julie and Jenny. Today’s harvest supplied three food banks: Sabathani, Joyce Uptown and Pillsbury United Communities.

For perspective, Matthew Ayres, director of the Joyce Uptown Foodshelf, told me they serve about 450 families per month a total of around 36,000 pounds of food. Joyce is the smallest of the three food banks who took corn today. According to the StarTribune there are about 350 food banks in Minnesota that collectively served 3.8 million people in 2020 (a 7% increase over 2019). Hard to imagine that a state with so much farmland has so much hunger.

It was a soggy Tuesday but our intrepid crew harvested corn for the good folks at the Gethsemane Lutheran Church Food Shelf in the Camden neighborhood (AKA Camden Promise) of North Minneapolis. Thanks to Cara Rodriguez, Sarah McCarthy and Jon Freise who braved downpours, mud and occasional lightening (not too close!), to harvest corn for the food bank.

Gethsemane’s food shelf provides thousands of pounds of food to individuals and families in North Minneapolis with food distributions six days a week. I’ve seen people lined up around the block awaiting their turn and fresh, top-quality sweet corn is welcome indeed.

Wow! What a day, what a crop, what volunteers! Our first corn harvest of 2021 was fabulous. Thanks to Cara, Erika, Julie, Lizette, Sarah M and Sarah P who collectively picked around 1,000 pounds of fresh, plump, organically-grown sweet corn which was promptly delivered to Pillsbury United Communities in the Phillips neighborhood and then . . . the plan was to deliver to Joyce Uptown foodshelf who earlier had said they’d be happy to have it but when I got there a sign on the door said they were closed due to a Covid-19 outbreak. But the sign also suggested calling Groveland Food Bank which I did and they took the remainder of the load (thanks, Jay!).

Would you like to help? We still need hands for next Tuesday, August 24th!